Today, the art of managing paper checks might seem like a relic of a bygone era. Yet, there are moments when voiding a check becomes a necessary skill. Be it for setting up direct deposits or ensuring a check can not be misused. So, how to void a check?

Well, in this article, we will walk you through everything you need to know about voiding checks.

What Is a Void Check?

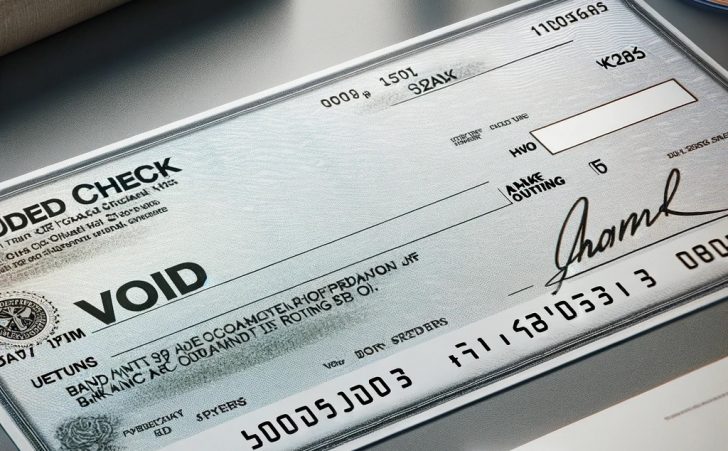

Before you ask how to void a check, let’s talk about what exactly a void check is. A voided check is a check that has been canceled or invalidated. By writing “VOID” across the front, you signal that the check cannot be used to make a payment.

FrontStory / Essentially, a void check is a bank check that the check owner has invalidated or canceled.

However, the check still contains valuable information, such as your bank account and routing numbers. These can be used for setting up electronic payments.

When to Use a Voided Check?

You might wonder when exactly you would need to use a voided check. There are several scenarios where a voided check comes in handy:

Setting up direct deposit: Employers often ask for a voided check to set up your paycheck deposit directly into your bank account.

Automatic bill payments: Utility companies and lenders might request a voided check to set up automatic monthly withdrawals.

Sometimes, you just need to provide your bank details in a secure way, and a voided check does just that.

How to Void a Check in 5 Simple Ways

Now, let’s dive into the crux of this article: How to void a check? Follow these five simple tips to ensure your check is voided correctly and securely.

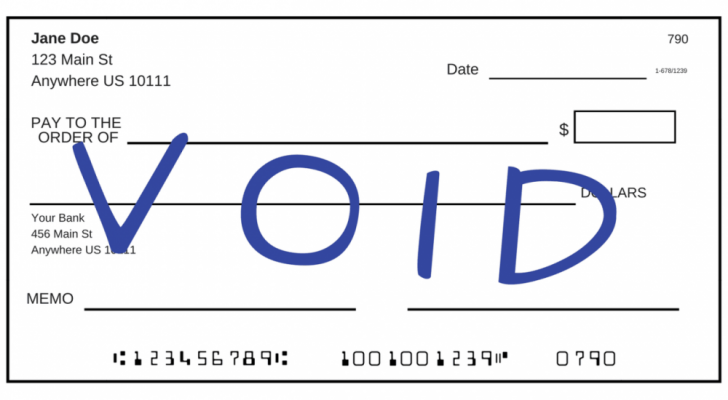

Marca / To void a check, use a permanent marker and write “VOID.” Easy and effective!

Use a Permanent Marker

Grab a permanent marker to write “VOID” in large letters across the front of the check. Ensure the writing is clear and covers the check sufficiently without obscuring the bank account and routing numbers.

This is crucial as these numbers are often needed for the reasons you are voiding the check in the first place.

Be Specific

If you are voiding a check for a particular reason, such as setting up direct deposit, you might want to write that reason on the check as well. For instance, “VOID for direct deposit setup.”

This adds an extra layer of security and clarity about why the check is voided.

Don’t Sign the Check

FrontStory / If you have written the wrong info on the check, don’t throw it away. Use creative ways of permanently erasing the wrong info.

When you void a check, there is no need to sign it. Signing it could potentially make it a target for fraud. Remember, a voided check is meant to be unusable for transactions.

So, keep it that way by not adding your signature.

Securely Dispose of Mistakes

If you make a mistake while trying to void a check (let’s say you accidentally write the wrong information on it), do not just throw it in the trash. Shred it or use another method to destroy it completely.

Thus, this will help you prevent any chance of the check being misused.

Keep a Record

After voiding your check, make a note of the check number and the date you voided it. Keeping a record is a good practice for managing your finances and can help you track what happened in case of any discrepancies with your bank account.