Advisory shares are a type of stock option given to company advisors rather than employees. They play a unique role, especially in the context of the popular reality show “Shark Tank.” So, what are advisory shares on “Shark Tank” and why do they matter?

In this article, we are going to explain it all. Without any further ado, let’s jump right in:

What are Advisory Shares to Begin With?

Advisory shares, also known as advisor shares, are options to buy company stock granted to advisors. These shares are a way for startups to compensate advisors who provide guidance and expertise without needing to pay cash.

So, instead of receiving a salary, advisors get the opportunity to buy company shares at a later date, often at a favorable price.

What are Advisory Shares on “Shark Tank”?

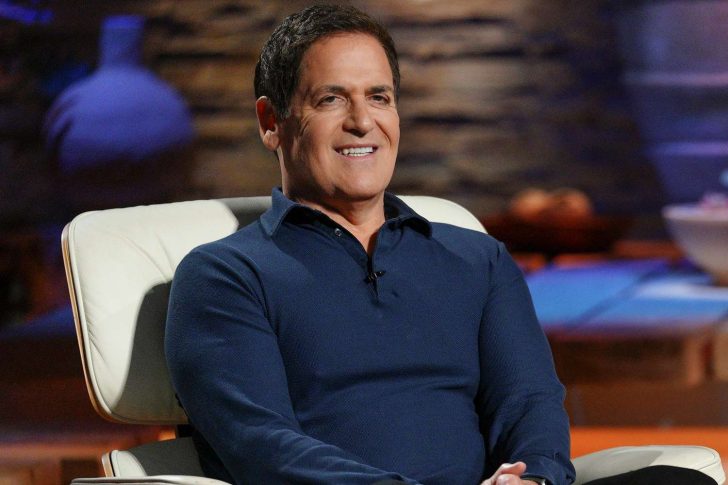

So, what are advisory shares on “Shark Tank” you ask? Well, on “Shark Tank,” entrepreneurs pitch their business ideas to a panel of wealthy investors, known as the Sharks.

Entrepreneurs Hub / If a Shark is particularly interested in a startup but doesn’t want to invest large sums of money, they might negotiate for advisory shares.

This way, they can offer their expertise and industry connections to the startup in exchange for future equity.

How Advisory Shares Benefit Startups?

For startups appearing on “Shark Tank,” advisory shares can be a crucial tool. Cash-strapped startups benefit from the advice and mentorship of seasoned entrepreneurs without draining their limited financial resources.

These advisory roles can significantly enhance a startup’s growth trajectory, leveraging the Shark’s network and knowledge.

However, Sharks choose advisory shares for several reasons. It allows them to support multiple startups without a substantial financial commitment. They can also diversify their portfolio and maintain a relationship with promising startups. Advisory shares give them a stake in the company’s success, aligning their interests with the entrepreneurs they mentor.

How to Issue Advisory Shares?

When a startup decides to issue advisory shares, they usually create a stock option plan. This plan outlines the terms, including the number of shares, the exercise price, and the vesting schedule.

The advisor agrees to these terms and provides their expertise in exchange for the potential future equity.

Vesting Schedule

A vesting schedule is a key component of advisory shares. It determines when the advisor can exercise their options to buy shares. This schedule typically spans several years, ensuring that the advisor remains committed to helping the startup over time. This long-term engagement is particularly valuable for startups needing sustained guidance.

YT / While advisory shares and employee shares both involve stock options, they serve different purposes.

Employee shares are part of compensation packages to motivate and retain employees. Advisory shares, on the other hand, are aimed at external advisors who provide strategic guidance. Both forms of shares align the recipients’ interests with the company’s success.

What are the Tax Implications of Advisory Shares?

Advisors must consider the tax implications of receiving advisory shares. Typically, the value of these shares is not taxed until the advisor exercises their options to buy the shares. At that point, the difference between the exercise price and the fair market value of the shares is considered taxable income.

However, it is essential to note here that several “Shark Tank” deals have involved advisory shares. For instance, a Shark might agree to provide marketing advice in exchange for a percentage of the company’s equity through advisory shares. These arrangements have led to successful collaborations, where startups benefit from the Shark’s expertise without giving up significant capital upfront.

Back to the question: What are advisory shares on “Shark Tank”? Well, advisory shares enable startups to leverage the knowledge and networks of seasoned advisors without immediate financial strain. For the Sharks, it is a way to foster relationships with multiple promising companies and share in their future success.